It takes quite a lot of time and effort to earn money and quite a few seconds to spend it on food, shopping, leisure, and paying off utility bills. Sometimes you never really know where your entire month’s salary has gone and your empty wallet just sticks the tongue out in the middle of the month. Setting up and abiding by a monthly budget is easier said than done. No matter how much loathe it, budgeting is crucial for financial success and a balanced happy life. This gets even more critical when you have just set out on your career and need to plan and review the incoming cash flow and the household expenditures accordingly. This needs to be done regularly to develop healthy financial habits and save money as you go about your life.

The best money management tool is the one that you will be utilizing in your daily life. Whether it’s a simple excel spreadsheet, a physical journal, or a fully dedicated budgeting app, you must use it to its fullest potential to benefit from money management in the truest of senses.

There is a myriad of budgeting tools and money management apps available out there on the web that you can get your hands on to get financial discipline in your life. These apps are usually available for free and can be downloaded on your android or apple device for easy use.

What is a Budgeting App?

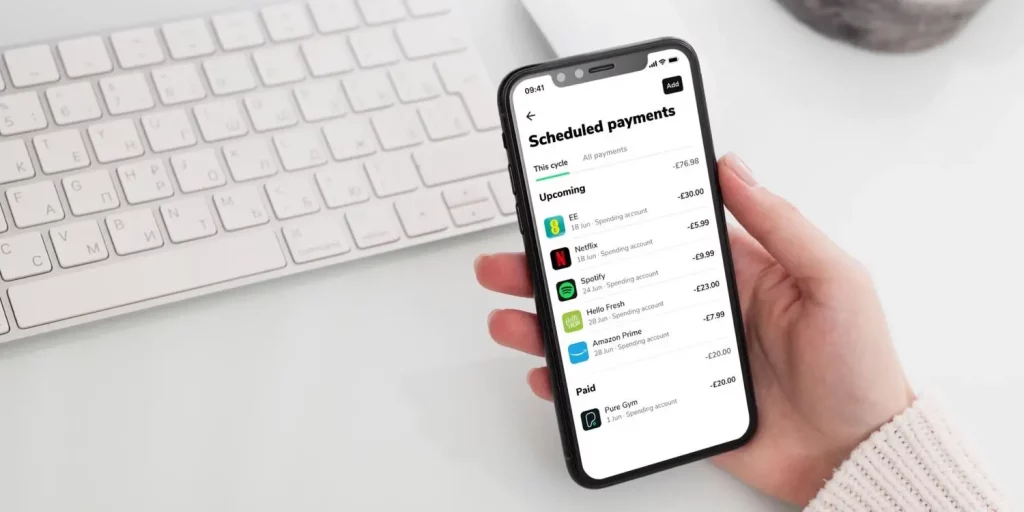

A budgeting app is a mobile application designed for helping you in optimizing your income so that you make a wise and suitable financial choice each month. It helps you in organizing your financial commitments and monthly goals in one place and helps you in reviewing your financial habits.

Set financial goals and track your cash flow coming from multiple sources with just a click. You can synchronize your budgeting app with your bank account or credit card to have a clear picture of the monetary choices you make over a month.

List of Best Budgeting Apps in 2023

Let’s have a look at some of the best budgeting apps that can help you keep track of your income and manage finances efficiently. The apps mentioned in the article are available readily for download for users in UAE. The user-friendly software has a wide selection of features and tools that you can use to manage personal finances.

-

-

-

Monefy

The Monefy app helps in tracking your finances and assists in managing your budget by encouraging users to break down their monthly expenses seamlessly and transparently. It helps the user evaluate their spending habits so that they can review their outgoing cash flow and start saving money.

The app boasts a user-friendly interface and provides an efficient tool to enter data as you spend money throughout the month. Moneyfy can be synced to multiple devices to help you access all your financial data in one place. The app maintains stringent security measures using face recognition and touch ID. -

Walnut

Walnut is a brilliant budgeting app available for download on both Android and Apple devices. The app is loaded with intelligent features including the option to split up the costs into different categories such as dining out, grocery, utility bills, shopping, school fees, and the like.

Walnut can also remind you of your incoming payments that you need to clear off on time. Besides this, you can also review your account balance from multiple accounts at the same time right in the app. The exciting fact about walnut is you can accomplish some tasks without having to switch on the Wi-Fi or mobile data.

You can also split the expenses and settle them with friends, transfer money, and pay card and utility bills within the app for free. -

Expense Manager

The Expense Manager app helps in budgeting and reviewing expenditures in a bid to help you save money and spend resources wisely. The feature-rich app boasts a user-friendly interface to put everything you need to manage finances at your fingertips.

Prominent features embedded in the app include generating a budget annually, monthly, and weekly, finance monitoring, expenditure division across categories, and setting up monthly spending limits. Other notable features that Expense Manager offers include a built-in calculator and currency converter.

The app allows users to customize the features and payment options according to their personal preferences.

Expense Manager is 100% free and can be downloaded easily on any Android or Apple device. -

GoodBudget

GoodBudget is a modern-day budget-tracking app designed to help you with your monthly spending. The advanced technology app keeps your salary aligned with your expenses so that you can spend your money where it ought to be spent.

The app breaks down revenue into envelopes to spend on different categories, tracks the user’s expenditures, and divides the transactions. You will receive extensive reports on the money spent and the income received each month. Detailed analysis can help you comprehend your budget so that you can spend your finances in the best possible way.

GoodBudget app can be downloaded for free on any Android or Apple device. -

Wallet

Next in our line of best money management apps in Wallet. The smart budgeting app is an interactive and efficient tool that helps a user keep track of their income and expenditures. It simplifies the job of managing expenses and analyses user information to generate helpful and informative results.

The Wallet app compares your monthly payable dues and notifies you when you overspend on a certain category. The app is safe to use and respects user privacy by keeping the input data safe and secure. -

Wally

Wally app will save you from the stress that accompanies the management of budget and finance. The smart application creates adjustable budget periods allowing you to track your expenditures every month.

Wally synchronizes your credit card, bank accounts, and loan accounts to provide you with a transparent and clear picture of your monthly expenses and incoming cash flow.

The app updates your account balance automatically and splits up the transactions to bring a balance to your financial life. The most interesting fact about Wally is that it displays your recent transactions, budget, and upcoming bills, providing you with a clear picture of your financial assets.

Last but not the least, the app can generate reminders for bills to be paid and create a shopping list to help you keep a track of your spending. -

Money Manager

The Money Manager app aids in simplifying the budget process and keeps it simple, fun, and effective. The app creates periodic budgets whether monthly or weekly, stores all your receipts, keep a check on your transactions with multiple filter options, generates an improvised monthly calendar to evaluate monthly expenditures, and creates informative charts to help you review your spending over specific periods.

The app also allows users to review asset trends with the help of charts and helps in budgeting the cash into various categories.

The Money Manager app also keeps track of your insurance expense and savings so that you know where, when, and how much of your cash is going. Get evaluations for your financial worth and bring discipline to your budget by downloading the app on your Apple or Android device. -

Spendee

If you are planning to save money for some major life goals such as purchasing a new car, aspiring for higher education, and planning a dream holiday trip, then Spendee can help make things simpler for you.

All you need to do is sync all your bank accounts, mobile wallets, and crypto-wallets within the app, and it will authorize you over your expenses including cash expenditures too.

Spendee keeps a record of all your transactions and provides you with valuable insights concerning your cash flow and expenses. -

FinArt

FinArt won’t let you miss clearing off your payable dues and household bills. With incredible features and a user-friendly interface, the app can help you manage your finances quite efficiently.

The app automatically synchronizes costs from all your bank accounts and allows you to check the account balance, credit card expenditure, and mobile wallet spending.

FinArt displays quite catchy graphics to display your expenses artistically and attractively.

The app is also smart enough to manage and supervise all your subscriptions and syncs them with your monthly expenses. -

Mint

The last budget planner app that made it to our list of best budgeting apps is the Mint. Mint helps the user to track their spending, minimizes the risk of fraud, and provides comprehensive details regarding all the subscriptions to help you figure out where exactly you can save on your finances. The customizable features in the Mint app assist the user in bettering their spending habits and creates an alignment between income and expenditure. Track the cash flow, plan for life goals, and save money with advanced budgeting features embedded in the Mint app.

-

Final Word

Managing finances and keeping a track of monthly income and expenditures is a task that not everybody is good at. While getting loans to cope with a sudden financial turmoil can help you deal with mismanaged finances, it is not a feasible solution to overcome poor money management.

If you find budgeting and managing money an arduous task, then you can consider opting for technology to help save the day. A budgeting or money management app can help you plan and map out a suitable budget to spend your hard-earned money in the right way. -